Whole Life Insurance Louisville - An Overview

Table of ContentsFascination About Term Life Insurance LouisvilleUnknown Facts About Life Insurance CompanyThe Buzz on Senior Whole Life InsuranceThe 20-Second Trick For Child Whole Life Insurance

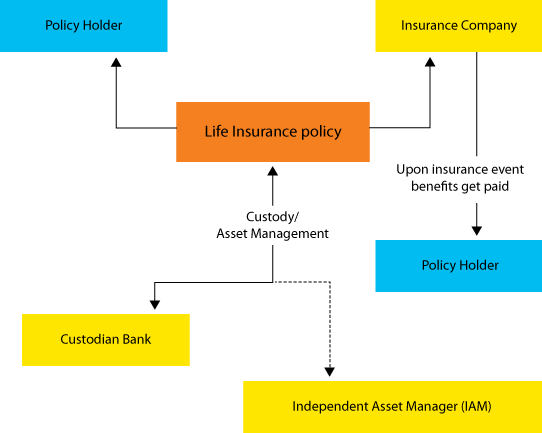

e., stocks and also bonds by the federal government. Life insurance policy basics: Terms, coverage needs and cost, Life insurance policy plans can differ extensively. There's life insurance policy for families, high-risk purchasers, couples as well as lots of other certain groups. Also with all those distinctions, many policies have some typical qualities. Below are some life insurance policy essentials to help you better comprehend exactly how protection works.For term life plans, these cover the price of your insurance coverage and also administrative expenses. With an irreversible policy, you'll additionally be able to pay money into a cash-value account. Beneficiaries are the individuals who obtain cash when the covered individual passes away. Selecting life insurance beneficiaries is an important action in preparing the impact of your life insurance coverage.

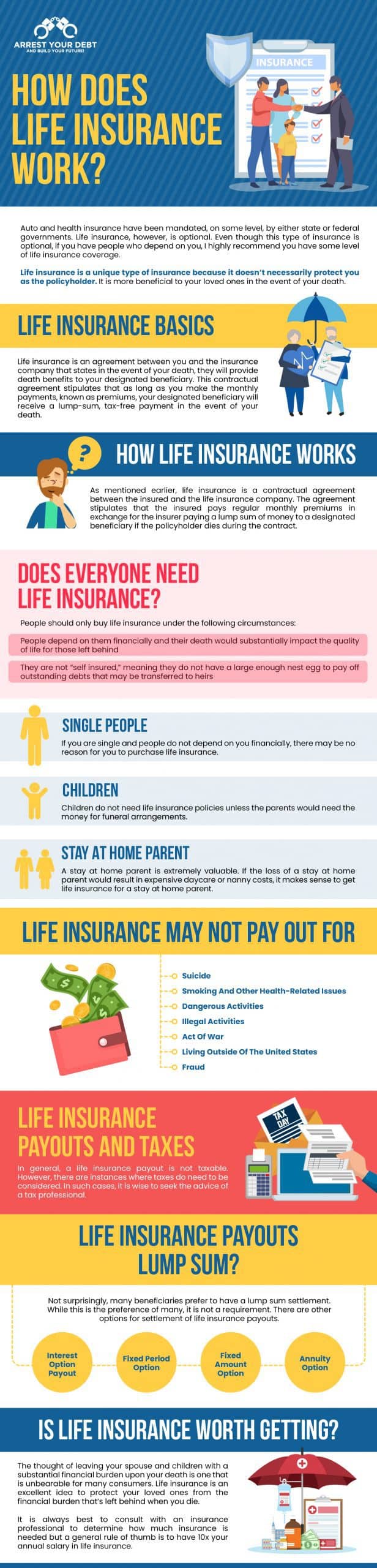

That needs life insurance policy? Like all insurance policy, life insurance policy was designed to address an economic problem.

9 Simple Techniques For Whole Life Insurance

If you have a spouse, kids or anybody dependent on you economically, they're mosting likely to be left without assistance - American Income Life. Even if no one relies on your earnings, there will certainly still be expenses related to your fatality. That can indicate your partner, kid or loved ones will certainly need to spend for burial and also various other end-of-life expenses.

If nobody relies on your revenue and also your funeral service expenses won't damage anybody's funds, life insurance policy might be a point you can miss. Yet if your fatality will be an economic worry on your enjoyed ones instantly or in the lengthy term, you may need a life insurance coverage plan.

If you're just covering end-of-life costs, you will not require as much as if you're attempting to replace lost income. The calculator below can help you approximate just how much life insurance you need. If you want an irreversible plan, attach with a fee-only financial expert. The advisor can assist you comprehend how a life insurance policy policy fits right into your financial plan.

Much healthier individuals are less most likely to die soon, which suggests business can bill them less forever insurance. More youthful individuals are also much less likely to pass away soon, so life insurance policy is less expensive (on average) for younger buyers (Life insurance Louisville KY). Women live longer, nonsmokers live much longer, people without complex clinical issues live much longer, and on and on goes the listing.

Some Known Incorrect Statements About Life Insurance

Lots of applications require a life insurance medical examination. The insurer will inspect your weight, blood pressure, cholesterol and other variables to try to establish your general wellness. Some companies will release life insurance policy without a medical examination, however you'll generally pay even more for insurance coverage. You might likewise be limited to much less protection than you're really hoping for, with some larger insurance companies maxing out no-exam plans at $50,000.

Employee life insurance policy can typically cover basic end-of-life expenditures and also might cover some or every one of your annual wage. Basic coverage typically does not require an examination and also may even be totally free.

Life insurance policy is a kind of insurance policy that pays a recipient in the event of the fatality of the guaranteed person. When a plan is bought, a details fatality advantage is picked. Life insurance policy is an agreement in between the policy owner and the insurance provider: the plan proprietor (or policy payer) agrees to pay a specified quantity called a costs.

Life Insurance Online Fundamentals Explained

If there are people who depend on you monetarily (including kids, a partner, a service partner, disabled or senior family members), having a life insurance policy policy will certainly safeguard them when they can no a knockout post more trust your earnings. If you have a mortgage or various other financial obligations, a life insurance policy policy can help settle debts and offer living expenses to individuals you call as recipients.

For many people, the need permanently insurance policy will certainly be greatest after beginning a family as well as will certainly decrease over time as kids expand up and also end up being independent (Child whole life insurance). Life insurance policy can help ensure future demands are satisfied which your family members preserves its standard of life, whatever life brings.

Remember to include the future prices of products you desire to pay for such as a home loan or educational expenditures. Some consultants advise an amount of life insurance that equates to or surpasses two to six times the annual income of the policyholder.

What are different kinds of Life Insurance policy? The main function of life insurance coverage is to supply for dependents should the household provider pass away.